What's on top of the house?

Why is your roof important? Why does it matter

what type of roof you have? How long should they last?

Why is your roof important? Why does it matter

what type of roof you have? How long should they last? Let's start with the basics.

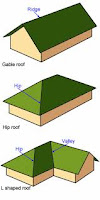

Common Roof Shapes

Gable: This is the most common, least expensive and easily built. It is recognized by it's Triangular shape. It is efficient for water/snow run off. The downside is they are prone to more damage during high wind storms. There are several styles of Gable roofs; Side, Crossed, Front and Dutch Gable.

Gable: This is the most common, least expensive and easily built. It is recognized by it's Triangular shape. It is efficient for water/snow run off. The downside is they are prone to more damage during high wind storms. There are several styles of Gable roofs; Side, Crossed, Front and Dutch Gable.Hip: This is very common also. It is recognized by the slopes on all four sides of equal length that meet at the top like a slope. Hip is more stable than Gable and are also efficient for water/snow run off. The downside is they are more expensive and are prone to leaks if they are not built correctly. There are several styles of hip roof; Simple, Crossed and, Half Hipped.

Flat: Flat roofs have a very slight pitch for water run-off. They are generally used in industrial and commercial buildings, but they can be used in residential building also. (Although some carriers will not insure a flat roof.) They offer additional living space on the roof for patios or gardens also.

Common Roof Types

Asphalt/Composite Shingle: These are the most common type of roof. Usually made of fiberglass and asphalt, they have a shorter lifespan than other choices. They claim to last up to 30 years, but in Texas, few composite roofs will last longer than 10 years without incurring significant weather damage. Clay Tile: This is considered to be the most durable of roofing materials. There are many colors and shapes, giving the homeowner more options on the look of their roof. It stands up well to mold and rot and hurricane winds. The main disadvantages are the cost and the weight of the tiles. You may need to install additional support beams if you are adding a tile roof. But the length of life for tile roofs can offset that cost.

Clay Tile: This is considered to be the most durable of roofing materials. There are many colors and shapes, giving the homeowner more options on the look of their roof. It stands up well to mold and rot and hurricane winds. The main disadvantages are the cost and the weight of the tiles. You may need to install additional support beams if you are adding a tile roof. But the length of life for tile roofs can offset that cost.Metal Roof: This is another durable option for roofing. You can get up to 50 years of life, with very little maintenance. Now you can also get metal roofing that looks like shingle or clay tiles. They can be painted also, giving you many choices for the look of your roof. the main disadvantage is the upfront cost, but you would make it up in the lack of maintenance costs.

There is much more to roofs than I have listed, but the basics are enough for now. Your roof age, shape and type make a difference in the cost of your insurance. Carriers can decide to not insure you because of your roof age, type, shape and/or condition. Why? Because it can cost anywhere from $7,000 to $30,000 to replace a residential roof, depending on the size, shape and materials. You have insurance so you do not have to pay that full amount. But the carrier does (minus your deductible), so they will inspect and discern if your roof is a risk they are willing to take on.

"We had a pre-sale inspection and they said the roof was fine so your carrier is wrong." (We hear this often from upset clients.) A pre-sale inspection stating the roof is fine does not override a carrier's decision not to insure the roof. They will send their own inspector out to look at the house, including the roof. Keep in mind, the carrier is the one who will pay out the cost to replace the roof, not you. They do have every right to decide if a roof is or is not in insurable condition. You can get upset, but it won't change their decision. Also keep in mind different carriers evaluate the condition of a home differently. One carrier may reject a roof while a different carrier will insure the same roof.

(So don't get too upset- there is a fix!)

Texas has some of the most volatile weather in the US. We have hail, hurricanes and tornadoes, often multiple times per year. Hurricane Harvey paid out 670,000 claims last year to the amount of $4.5 billion. A large part of that payout was flooding, but another large part was for roof claims for wind damage. Then there was Hurricane Irma in Florida. Why would that affect Texas rates? Because many carriers write in multiple states. So if there are $10 billion paid out in claims, as there was for Irma, it will affect entire company, not just Texas branches. Over $5 billion was paid out in hail claims last year in Texas. Those high amounts in claims have carriers scrutinizing roofs even more closely this year. They simply are not going to pay to repair or replace a damaged roof unless the damage happened on their watch. Plus material costs are rising each year. If the materials cost more, the cost to replace/repair will cost more and insurance pricing will increase. This is the nature of the business. This is another reason why it is a great idea to go through an independent agency. If your pricing goes up, independent agents can re-shop your rates.

Texas has some of the most volatile weather in the US. We have hail, hurricanes and tornadoes, often multiple times per year. Hurricane Harvey paid out 670,000 claims last year to the amount of $4.5 billion. A large part of that payout was flooding, but another large part was for roof claims for wind damage. Then there was Hurricane Irma in Florida. Why would that affect Texas rates? Because many carriers write in multiple states. So if there are $10 billion paid out in claims, as there was for Irma, it will affect entire company, not just Texas branches. Over $5 billion was paid out in hail claims last year in Texas. Those high amounts in claims have carriers scrutinizing roofs even more closely this year. They simply are not going to pay to repair or replace a damaged roof unless the damage happened on their watch. Plus material costs are rising each year. If the materials cost more, the cost to replace/repair will cost more and insurance pricing will increase. This is the nature of the business. This is another reason why it is a great idea to go through an independent agency. If your pricing goes up, independent agents can re-shop your rates. Your roof can make a big difference in your rates, so take care when you look at when and how you replace or repair. Always use a licensed roofer. It is a good idea to get referrals from people you trust. Get multiple estimates and choose who you are comfortable with!

There are

three ways to request a quote for your insurance needs: