Is It Time to Update Your Home Insurance Policy?

I don't know many people who enjoy talking to their insurance agent. There are few out there, but most of the time people want to put a policy in place and not have to deal with the process again. This is great. Low maintenance clients are our favorite kind! But there are conversations we need to have with you. Many people do not realize how changes in their lifestyle or their home can affect their home insurance policy.Marital Status

Did you get married? or are you now single? These changes can affect your rates. If you got married, you will want to put your spouse on your policy. If something happens to you and you are incapacitated, if your spouse is not on your policy, they cannot file claims or make decisions about the policy. If you are now single, you will want to remove your (previous) spouse from the policy so they may not make changes or decisions about the policy. Being married will usually lower your rate a little bit. Most carriers consider married couples to be a more stable risk. I know we all know people that would not be true of, but carriers compile several types of statistics to determine risk.

Did you get married? or are you now single? These changes can affect your rates. If you got married, you will want to put your spouse on your policy. If something happens to you and you are incapacitated, if your spouse is not on your policy, they cannot file claims or make decisions about the policy. If you are now single, you will want to remove your (previous) spouse from the policy so they may not make changes or decisions about the policy. Being married will usually lower your rate a little bit. Most carriers consider married couples to be a more stable risk. I know we all know people that would not be true of, but carriers compile several types of statistics to determine risk. High End Purchases

You have a certain amount of coverage for your Personal Property on your policy. If you buy a large screen TV or a high end computer system, this can eat into that coverage amount. Most carriers will offer options on the personal property amount. It is a good idea to keep receipts and take photos of any high end purchase for verification in case you file a claim. Home policies also cap the amount of coverage for jewelry, so if you buy a new piece of jewelry, you may need to change your coverage. You can add a "Schedule Personal Property" endorsement that will cover a specific piece of jewelry. You need to get a certified appraisal, including a photo to verify the value of the jewelry so the carrier can write the additional coverage for the exact amount of the piece. It is not subject to the policy deductible and will ensure you are fully covered.

You have a certain amount of coverage for your Personal Property on your policy. If you buy a large screen TV or a high end computer system, this can eat into that coverage amount. Most carriers will offer options on the personal property amount. It is a good idea to keep receipts and take photos of any high end purchase for verification in case you file a claim. Home policies also cap the amount of coverage for jewelry, so if you buy a new piece of jewelry, you may need to change your coverage. You can add a "Schedule Personal Property" endorsement that will cover a specific piece of jewelry. You need to get a certified appraisal, including a photo to verify the value of the jewelry so the carrier can write the additional coverage for the exact amount of the piece. It is not subject to the policy deductible and will ensure you are fully covered.Home Improvement

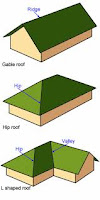

Remodeling/adding onto your home can increase the Replacement Cost on your Dwellingvalue. The dwelling value is what the carrier determines it would cost to rebuild your home from the ground up in the case of a catastrophic loss. This can includes remodeling the kitchen or bathrooms, adding a pool, changing out plumbing. Not everything will affect your dwelling value, but talk to your agent about any changes you are planning.

Pet Changes

Have you adopted a dog recently? Some dog breeds are prohibited by carriers (think Pit Bulls and German Shepherds). I know your dog is not a problem, but again, statistics show that certain breeds are more aggressive and carriers don't want to pay out those claims so they make them ineligible. If you have an ineligible dog breed, your carrier may cancel your policy outright or they may exclude liability coverage for anything that has to do with the dog. If you do not disclose the dog, they may deny a claim because of fraudulent information on the policy.

Have you adopted a dog recently? Some dog breeds are prohibited by carriers (think Pit Bulls and German Shepherds). I know your dog is not a problem, but again, statistics show that certain breeds are more aggressive and carriers don't want to pay out those claims so they make them ineligible. If you have an ineligible dog breed, your carrier may cancel your policy outright or they may exclude liability coverage for anything that has to do with the dog. If you do not disclose the dog, they may deny a claim because of fraudulent information on the policy.Home Security Systems

Have you added a monitored alarm system? Turned your home into a "Smart Home"? These can save you money on your policy. Now I believe having a monitored alarm system is a very good idea, but it will not save you the same money you will spend installing and maintaining the system. You add a security system for one reason- security. And no, the system that notifies you on your iphone is not a monitored alarm. It must be monitored by a certified alarm company that notifies the police and/or fire department.

Have you added a monitored alarm system? Turned your home into a "Smart Home"? These can save you money on your policy. Now I believe having a monitored alarm system is a very good idea, but it will not save you the same money you will spend installing and maintaining the system. You add a security system for one reason- security. And no, the system that notifies you on your iphone is not a monitored alarm. It must be monitored by a certified alarm company that notifies the police and/or fire department. When you are coming up on your insurance renewal it is a good idea to keep these things in

mind. If you have made any of these changes, be sure to let your agent know so that you will be sufficiently covered. Also let them know any contact information changes. We have had people move, change phone numbers and email addresses and then act completely shocked when we don't know about the changes. Agents do not know you have made these changes unless you tell them! You can email or call into your agent; just let them know!

There are

three ways to request a quote for your insurance needs:

* Call Brockman

Premier Insurance at 877-987-8683